Myanmar’s long-awaited new companies law might have hit an unexpected delay, but when it is finally enacted, it will be a watershed piece of legislation benefiting local companies and foreign investors alike.

In December, Myanmar President Htin Kyaw finally approved the country’s most anticipated piece of legislation of 2017: the Myanmar Companies Law (MCL). The long-awaited new companies law, which does not have a set commencement date yet [see BOX on the delay], will replace the British colonial-era Myanmar Companies Act (MCA), which was enacted more than a century ago, in 1914. The MCL promises to radically overhaul the existing business regulatory framework.

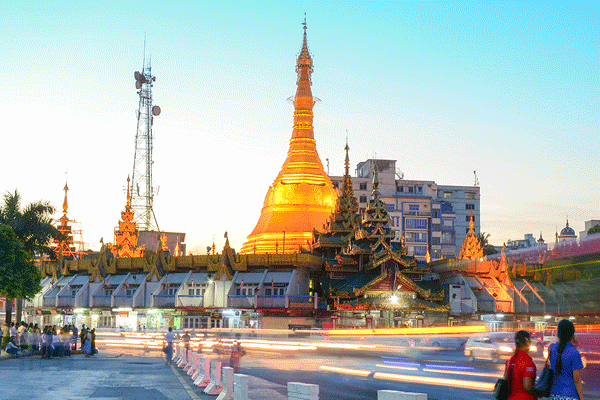

The Burmese government hopes this key piece of legislation will lay the foundation for the Southeast Asian country to become an attractive investment destination, and bring much-needed foreign capital to one of the poorest countries in the region.

It wasn’t always like this for Myanmar, formerly known as Burma. The country was once one of the strongest economies in Southeast Asia before independence from the British in 1948. But the country fell into poverty after decades of mismanagement by the oppressive military junta, which ruled from 1962 to 2011.

There was great hope when Aung San Suu Kyi, a Nobel Peace Prize laureate and the daughter of an assassinated Burmese independence hero, led her National League for Democracy party to a landslide victory in a landmark democratic election in 2015. However, the new government’s challenging first year, coupled with lower than expected economic growth, left local companies and foreign investors disappointed.

Growth in both foreign investment and gross domestic product have slowed since Suu Kyi took power, and Myanmar remains one of the least invested jurisdictions within the ASEAN region.

Myanmar recorded monthly average foreign investment of $739 million last year, below levels reported in 2015 under the former military-backed government, according to consultancy Roland Berger.

The International Monetary Fund had downgraded Myanmar’s gross domestic product growth forecast for 2017-2018 to 6.7 percent from 7 percent. IMF’s Myanmar mission chief, Shanaka Peiris, said that’s still a “significant acceleration” compared with 5.9 percent from a year ago, thanks to a recovering agriculture sector and exports, reported Reuters.

A NEW HOPE

The new companies law aims to set the country up for growth and pave the way for foreign investments to come with sweeping reforms of the corporate sector. The much-anticipated reform aims to make doing business in Myanmar much more certain and attractive, says Chris Hughes, partner and head of Myanmar at Berwin Leighton Paisner, who drafted the MCL.

It also complements the recently implemented Myanmar Investment Law (MIL), which simplifies procedures and giving foreign investors equal treatment to the locals, he adds.

As part of the previous government’s agenda to open Myanmar’s economy, the reform process began around 2013-14, and policy development, drafting and consultations took place through 2014 and early 2015, notes Hughes. “Since then, the business community has been eagerly awaiting the implementation of the law as it provides a much clearer and well-developed basis for doing business in Myanmar,” he says.

The MCL provides the framework for corporate activity and fundraising, and also liberalises new areas of investment alongside the investment law, explains Hughes. The MIL sets out a comprehensive set of investment rights protections as well as incentives for investment in priority areas.

“Both laws level the playing field for Myanmar and foreign investors and provide a secure platform for large-scale foreign investment in the country,” he says, “We’re all just waiting for it to commence!”

KEY CHANGES

The wait might be worth it. There are several significant changes to the new law, and one of the biggest is the re-classification of what constitutes a “Myanmar company” and a “foreign company.”

Under the old companies law, a Myanmar company had to be 100 percent-owned and controlled by Burmese citizens unless the Directorate of Investment and Company Administration approved changing the classification to a foreign company, which was almost impossible to obtain.

But under the new companies law, foreigners can own up to 35 percent of a Myanmar company without having to change the classification to a “foreign company,” which would make it subject to investment restrictions, notes Yusuke Yukawa, partner and Yangon office representative of Nishimura & Asahi.

These Myanmar companies with up to 35 percent foreign ownership will also be able to invest in companies listed on the Yangon Stock Exchange. That said, the exchange, which is less than two years old, currently has just five companies on it.

Other currently restricted economic activities that will be accessible with the change in the classification of a “foreign company” is the ownership of land – specifically, the understanding of the Transfer of Immovable Property Restrictions Law (TIPRL).

The law, which was enacted back in 1987, prohibits the ownership or long-term lease of land by foreign-owned companies, making lending by foreign banks difficult as the banks are unable to use the property as security.

“Offshore bank financing has been complicated because of the inability of foreign banks or finance providers to use land as security,” says BLP’s Hughes. “The new law should help facilitate this, giving lenders greater comfort in their ability to protect their interests, and it is large scale offshore financing that Myanmar needs most to address its infrastructure and other development challenges.”

Though it seems the new policies will relax the previously strict rules governing foreign investment into Myanmar companies, not all sectors will be open to foreign participation.

“It should be noted that Myanmar government authorities still retain their own discretion when it comes to restricting foreign ownership in specific areas,” note partner Eric Eunyong Yang and foreign attorney Cheolhyo Ahn of Bae, Kim & Lee. For example, the Central Bank of Myanmar may restrict foreign ownership in financial institutions.

Other significant changes to the new companies law include the refining of rules related to transfer of shares. Foreign shareholders of a company will no longer be required to obtain prior approval from government authorities to transfer shares, say Yang and Ahn. Under the MCL, authorities only need to be notified when foreign shareholders own more than 35 percent of a company.”

BLP’s Hughes cites other key changes that include the removal of the requirement to hold a separate “permit to trade” and to include regulator-approved corporate “objects” in a company constitution.

As these were additional means to restrict activities of foreign enterprises, he says, the changes have the potential to make foreign investment easier.

The introduction of provisions which allow flexible capital structures – for example, through having different share classes – and changes to that capital structure, such as through shareholder-approved capital reductions, is also expected to help foreign investment, he notes.

“It will mean that you can move capital in and out of Myanmar in more efficient ways. The new law will also allow higher returns on some shares to attract investors who might otherwise be unwilling to accept the risk of investing in what is still quite a frontier market,” he explains.

“Different share classes will be helpful in the joint venture context, too, potentially allowing investors to have greater control over their investments as well as improved economic terms,” he adds. “Myanmar businesses will be big winners here, as well, as they will find it much easier to attract the overseas capital and expertise they desperately need to expand their businesses.”

The MCL will also improve the ease of doing business, says Hughes. Simplified and certain company incorporation and maintenance procedures, as well as a modern corporate governance regime will ensure better corporate behaviour, stakeholder protection and corporate performance, he adds.

“A clear and extensive corporate governance regime offers much better protections for creditors and shareholders, too, as the standards expected of directors are increased, while also giving directors the encouragement to take well considered risks with the benefit of a business judgment rule,” he explains.

“Investors have far better protections now, so they can operate here with confidence that their investments will be safeguarded.”

ADVICE TO CLIENTS

With all these changes to consider for local companies and foreign investors, lawyers are asking clients to take note of a few more things that could be easily missed.

For BLP’s Hughes, there are two dimensions to the MCL. Firstly, there are changes which must be made in the short term just to ensure compliance with the new law.

"Companies here will be able to remove the ‘objects’ clauses from their articles which currently limit their range of investment activities and also pre-emptive rights provisions. The clauses can limit their agility when taking on new investment,” he says.

“Secondly, there are now many mechanisms available for structuring an investment to improve returns and better manage risks that weren’t there before. We are urging our clients to take a close look at these provisions and consider restructuring opportunities to increase value.”

BKL’s Yang and Ahn reminds clients to appoint a Myanmar resident director on their board if they don’t already have one. “There is a new requirement of Myanmar residency for at least one resident director of a company,” they explain. “Appointment of a resident director or arrangement of one Korean (or other foreign) director to stay in Myanmar for at least 183 days per year will be a compulsory requirement.”

N&A’s Yukawa adds, “While the MCL provides a grace period of 12 months for appointing such ordinary resident director or representative, our Japanese (or other international) clients should take necessary internal measures to appoint an appropriate person to meet that requirement within the set schedule.”

“Also, branches of foreign companies will be subject to more detailed reporting, including on changes to the status of their headquarter offices, to the relevant authority under the MCL. This was not necessary under the MCA,” notes Yukawa. “Under the new law, each branch should confirm exactly what items need to be reported and be prepared to closely correspond with their headquarters so that such reports can be made within the deadline.”

“Finally, while the MCL provides more flexibility in corporate governance, including the share structure of foreign subsidiaries, it needs to be seen whether actual practice will be entirely consistent with the wording of the MCL,” he says. “We strongly recommend that advice from legal professionals be sought to confirm the latest operation of the law in actual practice.”

Myanmar to delay law that would have allowed more foreign investment

By Thu Thu Aung and Yimou Lee of Reuters

Myanmar will delay a long-awaited reform that would open the door further to foreign investment, two officials told Reuters. The move will likely disappoint cash-starved businesses amid growing doubts over the management of the economy by the country’s leader, Aung San Suu Kyi.

The postponement of the corporate reform, which would have allowed foreign companies to take up to a 35 percent stake in Myanmar companies, will likely deal a fresh blow to investor confidence in Suu Kyi’s administration.

Economic reform is a strategic goal for her to complete Myanmar’s democratic transition after decades of isolation under military rule.

The delay underscores the daunting challenge facing Suu Kyi, whose promise of a reformist government that would attract foreign investment is under threat.

Some aid to Myanmar is already being withheld and investors are concerned that the sanctions that long hobbled the country’s economy will be reinstated over its treatment of its Rohingya minority.

A Myanmar companies law, which could bring much-needed foreign capital to the country after decades of mismanagement by the former military junta, was approved last month by President Htin Kyaw without a commencement date specified.

Aung Naing Oo, head of Myanmar’s Directorate of Investment and Company Administration (DICA), says the authorities may not be ready to implement the new rules until as late as August 2018, after bylaws were prepared and a company registry that he said was vital to enforcement was completed.

“We really want to implement the law as soon as possible but there are many things for us to do,” he says, declining to elaborate what bylaws were needed. He says the government will make sure implementation will be no later than August 1. “We have to make sure the reform is on the right track.”

Myo Min, director of DICA, says the authorities need up to eight months to “work on the guidance and operating manual” for the country’s first modern online registry, an initiative driven by the Asian Development Bank to electronically revamp the country’s company registry to boost transparency.

The law includes a first set of modern corporate governance regulations, in some parts replacing rules made over a century ago, to bring the country’s business regulatory framework closer to international standards.

At issue is a clause that allows foreigners to take up to a 35 percent share in local companies, which would give local businesses access to a larger capital pool and open up the door for mergers and acquisitions in sectors that are in urgent need of an injection of cash from banking to property.

The delay of the much-anticipated reform comes as Suu Kyi faces criticism that she has neglected economic reforms. Growth in both foreign investment and gross domestic product slowed since her National League for Democracy took office last year in one of the region’s poorest countries.

Htay Aung, president of the property-to-trading conglomerate Sakura Trade Center, says putting off implementation of the law is “bad for business as it will bring delays and extra costs, which result in losses”.

The company is seeking $100 million in overseas financing for a condominium development in Myanmar’s commercial hub, Yangon. “Foreign investment will be postponed and local businessmen will be disappointed.”

’MISSED OPPORTUNITY’

Investors have been waiting for the corporate reform, which was initiated by the former military-backed government in 2014. It establishes guidelines on how a company is run and governed, removing outdated rules on share transfers and offering greater protection to shareholders.

But Hughes of BLP says it is a “missed opportunity” for Suu Kyi’s administration.

“I can’t see a compelling economic reason or policy behind the delay. It seems more driven by technology or administrative factors.”

William Greenlee, managing director at DFDL in Yangon, says the business community will struggle with the delay.

“International investors are watching and it is wins like this that create a buzz and can materialize into a profound and sustained increase in foreign investment,” he says. “The euphoria will quickly turn to disappointment if it is not implemented quickly.”

Aung Naing Oo of DICA says there will be no negative impact on investment. “Investors always need to take some time before they invest,” he says. “So this actually is the time for investors to make preparation to invest in Myanmar.”

The Asian Development Bank, which gives financial and technical assistance to Myanmar, says “it is ultimately the government’s decision when the law comes into force,” declining to comment further.