Hong Kong’s IPO market, the world’s leader from 2009 to 2011, has stumbled in the last few years. The pulling of potential mega IPOs in recent months has added to the uncertainty. However, recent figures indicate that the market is clawing its way back, with a healthy volume of listings in the pipeline for 2014. And with new rules in force to boost investor confidence, the signs point to a gradual ascent of the city’s IPO market. Kanishk Verghese reports

After a sluggish couple of years, Hong Kong’s IPO market had a strong showing as 2013 drew to a close. The momentum continued into the first quarter of 2014, with listings by HK Electric Investment and Harbin Bank raising HK$24.1 billion ($3.1 billion) and HK$8.8 billion, respectively. Their listings, coupled with several mid-market public offerings, suggest that Hong Kong’s IPO market is finding its feet again. According to Thomson Reuters data, Hong Kong IPO volumes in the first quarter of 2014 totaled $5.9 billion, up from the $1.03 billion raised a year ago. “Overall, the number of IPOs completed during January to April 2014 exceeded those completed during the same period in 2013,” says Ronny Chow, a partner at Deacons in Hong Kong. “In terms of market activity, based on the deals in the pipeline and the number of instructions and IPO enquiries we have seen, there continues to be a strong level of interest from companies planning to list their shares in Hong Kong,” says Chow.

Investors’ tastes are also changing. “Hong Kong investors like new things,” says Carolyn Sng, a partner at Fried, Frank, Harris, Shriver & Jacobson in Hong Kong. “The current buzz is over IT stocks and things that are different,” says Sng. Indeed, the first quarter of this year saw an eclectic mix of companies launch an IPO in Hong Kong – Magnum Entertainment was the first nightclub to list in Hong Kong, while Haichang Holdings and Poly Culture were the first Chinese theme park operator and auction house, respectively.

Back to topThe deals that weren’t

However, the pulling of several mega IPOs in recent months suggests that market sentiment may not be as rosy as it appears. In one highly publicised event, Chinese e-commerce giant Alibaba Group decided in March, after months of debate, to forego its Hong Kong listing aspirations in favour of an IPO in the United States, in what could be the largest technology debut in history.

In the same month, A.S. Watson, a health and beauty retailer that had been expected to list in Hong Kong, sold a 24.9 percent stake in the company to Singapore state investor Temasek Holdings for about $5.7 billion. Li Ka-shing, Asia’s richest man and the owner of A.S. Watson, has said he is still considering an IPO in Hong Kong and Singapore, but any such offering is only likely to happen in two to three years.

And in late April, China’s WH Group, the world’s biggest pork company, pulled its planned Hong Kong IPO due to weak demand for the deal, even after it slashed the offer size by two-thirds. This was a result, fund managers and bankers say, of WH Group and its owners seeking too high a price, hiring too many underwriters – a record 29 – as well as negative publicity over some sky-high executive compensation. “I don’t think these deals are necessarily indicative of the market, but certainly with such a big high-profile deal pulling at the last minute, it puts a damper on the mood,” says Sng.

Back to topA healthy pipeline

However, lawyers do not believe these cases are a great cause for concern. “The cancellations are case-specific to the companies and their investors, and do not reflect a weakness in the IPO market generally, or the suitability of the other candidates coming to market,” says Richard Hall, a partner in Conyers Dill & Pearman’s Hong Kong office.

Indeed, WH Group’s overly ambitious valuations and Alibaba’s attempt to change the “one-share-one-vote principle” were unique cases. In the Alibaba debate, while banks in Hong Kong may have missed out on earning substantial fees from an IPO, lawyers highlight that the Securities and Futures Commission (SFC) of Hong Kong’s decision not to chase the dollar is going to boost investor confidence in the region. “On balance it is a good thing because it sends a positive message that our regulator believes in the system, and is not easily swayed by one high-profile applicant,” says Catherine Tsang, a partner at Paul Hastings in Hong Kong.

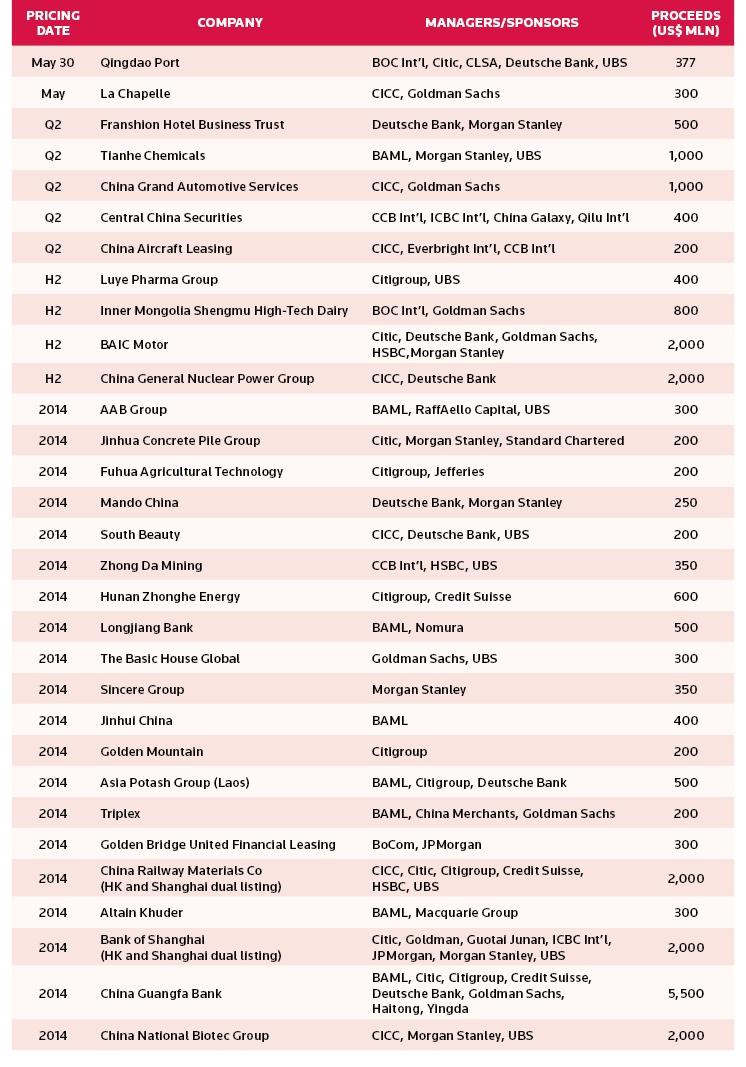

Furthermore, while Hong Kong is unlikely to see a deal the size of Alibaba’s in the immediate future, several noteworthy IPOs still remain in the pipeline. For instance, China CNR Corp, the world’s largest train maker by sales, raised $1.2 billion in a Hong Kong share offering in May. The second half of the year is also set to see potential $2 billion offerings by China General Nuclear Power Corp, China Railway Materials Co, the Bank of Shanghai and China National Biotec Group, as well as a proposed $5.5 billion listing by China Guangfa Bank (See Table).

“There will continue to be a mix of companies seeking to list in Hong Kong,” says Sabrina Fung, a partner at Deacons in Hong Kong. “We expect most will still be PRC based, but from diverse sectors such as financial services, pharmaceuticals and health care, TMT, consumer related, and F&B,” says Fung.

Also on the horizon are the potential listings of several Chinese companies that have been taken private and delisted from the U.S. stock exchanges in recent years. “Hong Kong is a good bet for them because it has always understood Chinese companies. Those deals will take some time to cook, but that shows some confidence in the market,” says Sng. One such deal in the works is the potential listing of Focus Media Holding, a Chinese display advertising company. Focus Media was delisted from the Nasdaq stock market and acquired by The Carlyle Group and other private equity firms last May for $3.8 billion. The company is now planning a $1 billion IPO in Hong Kong in early 2015, Reuters reports, citing sources familiar with the plans.

Back to topRegional developments

There have also been a number of regulatory developments in the region, which are predicted to have varying effects on Hong Kong’s IPO market. On April 1, new disclosure rules were enacted with the aim of improving the quality of IPOs and clamping down on fraud. Listing applications are now made public as soon as companies pass an initial checklist after filing them with the exchange. Incomplete applications will be rejected and banks and issuers submitting such applications will be named publicly and face an eight-week waiting period to refile their documents. Under the previous regime, the so-called “A-1” document was filed and remained private until it was vetted and approved, while sponsors could also file incomplete documents and resubmit them without facing major penalties.

As a result of the new regulatory regime, companies scrambled to submit their listing applications with the Stock Exchange before April 1. “There was definitely a rush. We filed two applications on the last day before the new regime took effect,” says a partner at an international law firm in Hong Kong who wished to remain anonymous. “But at the same time, we also filed an application after April 1, and the process turned out to be pretty similar. However, there is certainly a fear factor, and it will continue to linger. But people will get used to it, and the new regime will do a lot of good overall for the Hong Kong market,” says the partner.

According to Deacons’ Chow, there has already been a general escalation of standards in terms of prospectus drafting, which will likely enhance the prospectus vetting procedure timeline by the Stock Exchange. “Based on the statistics published by the Stock Exchange, the median vetting time and average number of regulatory comments have both been substantially reduced by more than 50 percent since the new regime became effective,” adds Chow.

While the new regime is having a positive effect on the quality of IPOs in Hong Kong, some market analysts note that there hasn’t been an effect as of yet on the number of deals actually coming to market, which is linked much more to market performance than to the changes in regulations. The rush to file listing applications before April 1 will have likely artificially skewed the numbers, says Paul Hastings’ Tsang. “Once the effects of that rush go away by the second half of this year, observations of the market then may be a better indication of what really lies underneath,” says Tsang.

Across the border, the China Securities Regulatory Commission (CSRC) reopened China’s A-share IPO market in January after imposing a 14 month ban on new listings in a bid to shore up weak domestic markets. However, problems with the listings, including accusations of overpricing and insider manipulation, resulted in dozens of companies cancelling their listings while the CSRC investigated underwriters and inside investors for irregularities. At the same time, the CSRC effectively held off from processing applications from 600-plus companies still in the queue in order to revise regulations.

Then, in late April, the CSRC resumed publishing IPO applications on its website and issued new, detailed rules governing IPOs, the publication of which was seen as clearing the way for the resumption of new listings. Despite this progress, the stop-start nature of the CSRC has led some market watchers to worry that the resumption of mainland IPOS could fail to meet expectations. Furthermore, a long queue of companies waiting to list could motivate some to look towards Hong Kong. “Right now it is quite stop-start, and the backlog runs into the hundreds. People are waiting to see how the rules will work out, and whether this will be long term and stable,” says Sng. Nonetheless, given the preference for a listing on an international exchange, the reopening of China’s domestic IPO market will have a limited effect on the IPO market in Hong Kong, which has a strong pipeline of upcoming IPOs scheduled for the foreseeable future, says Conyers’ Hall.

Deacons’ Fung too has not seen any major impact of the reopening on Hong Kong’s IPO market. In fact, based on the statistics published by the Stock Exchange, the number of listing applications accepted by the Exchange during the first four months in 2014 has increased by more than 80 percent as compared to the same period last year, says Fung.

In other developments, the CSRC and the SFC announced a pilot scheme in April to allow mainland investors to trade shares in designated companies listed in Hong Kong, while letting Hong Kong investors buy selected Shanghai-listed shares. The pilot project, which will launch after a preparation period of about six months, will be limited to companies already listed in both Shanghai and Hong Kong, as well as other selected blue-chip companies. While the project is unlikely to have a direct impact on Hong Kong’s IPO market, it will increase liquidity in the market and boost both Hong Kong and China’s systems, lawyers say. However, they add, this will depend on how the scheme is implemented and who can participate.

At the moment, the pilot scheme imposes a number of limitations and quotas. During the trial period, Hong Kong investment in mainland stocks will be limited to an overall quota of 300 billion yuan ($48 billion) and a daily quota of 13 billion yuan. Mainland investment in Hong Kong stocks will be limited to an overall quota of 250 billion yuan and a daily quota of 10.5 billion yuan. Hong Kong will also require mainland investors to be institutions or individuals with at least 500,000 yuan in their accounts. While there will be restrictions in place, the on-the-ground reality appears to be that prior to the implementation of this pilot scheme, there has already been a steady stream of investments in Hong Kong stocks by PRC companies and individuals that could meet similar requirements, says Rhoda Yung, a partner at Deacons in Hong Kong. “Taking that into account, the impact of the pilot scheme, as it currently stands, on the HK IPO market may not be as significant as some might expect,” says Yung.

Furthermore, Sng notes that there will be several regulatory issues for the CSRC and SFC to consider, including securities regulation and money laundering concerns. “The detailed rules are not out yet, but how this is going to work in practice is difficult to see at the moment,” says Sng.

Back to topBetter days ahead

Looking ahead, the future looks promising for Hong Kong’s IPO market. “While the overall outlook has been uncertain for a while, Hong Kong has also had a lot of success. A lot of deals that have been in the pipeline for a long time have gone out, as well as some new deals. It is still sporadic, but it is much healthier than it was over the last two years,” says Sng.

As the IPO market steadily turns the corner, lawyers expect to see fewer mega deals and more mid-sized listings in the coming years. Especially after WH Group’s pulled IPO, investors and banks will be cautious about going ahead with big-ticket deals. “There are still completion risks for those mega deals due to uncertainty in market sentiment, but we do not envisage any significant impact in terms of mid-market deals,” says Chow. “2014 will be a good year. There are a lot of IPOs in the pipeline,” he adds. In fact, KPMG predicts Hong Kong’s IPO market to raise more than HK$200 billion in 2014 – a 25 percent growth over the previous year. “It is a global economy these days, and there are always ups and downs,” says the partner who asked to remain anonymous. “It is buoyant in London and New York right now. It takes turns, so for cities like London and New York that have had a few bad years, it is hardly surprising that they are making a comeback now. I’m sure our turn will come in due course. The Chinese market is too big to be quiet for a lengthy period, so I am hopeful in the long run.”

Back to topHong Kong IPO pipeline

The following are some of the major companies planning initial public offerings and new listings on the Hong Kong Stock Exchange (as of May 26, 2014).

--Compiled by Elzio Barreto of Reuters

Back to top