Despite the uncertainties of 2016, Malaysia’s M&A scene saw some significant dealmaking last year, and lawyers are seeing more of it in 2017.

The year 2016 has been generally viewed as a challenging year for global markets, with factors including falling crude oil prices as well as political events such as Brexit and the various policy changes in the U.S. stemming from a new administration leading to an overall economic slowdown.

Despite these hurdles, Malaysia still managed to record an economic growth of 4.2 percent in 2016, and this year started off even better, with the country posting a 5.6 percent growth in the first quarter of 2017. Moreover, when it came to mergers and acquisition (M&A) deal activity, the numbers were equally good.

According to Duff & Phelps, as of November 2016 a total of 375 transactions had taken place, the highest since 2013. Total M&A deal value in the first 11 months of the year reached $14.6 billion, up from $8.8 billion a year previously.

Domestic M&A deals comprised half of the total deal value in 2016. Lawyers say that there is increased optimism for Malaysia’s immediate future, not least because of the potential of greater investment from China. The two countries recently signed 14 agreements for projects valued at up to $33 billion. “We expect that the continued influx of Chinese investments will continue to encourage M&A activities here in Malaysia, either in the form of JV partnerships with Chinese investors, or more Chinese investors coming in to acquire assets and companies in Malaysia in the relevant sectors,” says Kuok Yew Chen, a partner with Christopher Lee & Ong, Rajah & Tann’s associate law firm in Malaysia.

THE POWER OF SMALL

One area that has seen a lot of activity has been small and medium enterprises (SMEs). According to Malaysia’s Ministry of International Trade and Industry, SMEs account for 97.3 percent of a total of 662,939 business establishments in Malaysia.

The introduction of the equity crowdfunding regime and the growing trend of startups in Malaysia have resulted in an increase in M&A activity in the SME sphere. Angel investors and venture capitalists are constantly looking out for the next new business to invest in.

However, traditional sectors also remain strong. According to the Duff and Phelps report, the top sectors in Malaysia based on deal value last year were real estate, energy and telecommunications.

For example, the largest M&A deal in 2016 was the acquisition by IWC-CREC – a consortium between Iskandar Waterfront Holdings and China Railway Engineering Corporation – of a 60 percent stake in Bandar Malaysia.

Despite, or even perhaps as a result of, the slump in global oil prices, the oil and gas sector in Malaysia has seen some M&A activity. Notable transactions include MISC Berhad’s acquisition of a 50 percent stake in Gumusut-Kakap Semi-Floating Production System.

The TMT sector has also seen several large transactions, including Axiata Group’s private placement exercise in its telecommunications tower subsidiary, edotco Group.

DIGITAL BOOM

According Christopher & Lee Ong, there is also increasing activity in the digital space, particularly mobile apps and online businesses.

“Given that these are relatively new business structures, there is considerable uncertainty over the regulation of such businesses,” says Kuok. “The government has indicated that they will be introducing new legislation to regulate e-businesses, which are currently operating in an unregulated environment.”

With the recent launch of the Digital Free Trade Zone (DFTZ) by the Malaysian prime minister, law firms expect to see continued growth in M&A transactions in the digital business space. “It is expected that e-commerce will continue to grow exponentially in Malaysia,” says Kuok.

*******************

BACK TO THE FUTURE

Mahathir’s comeback renews Malaysia’s opposition in looming polls.

Prime Minister Najib Razak won Malaysia’s last general election, despite losing the popular vote. Since then, he has been embroiled in a corruption scandal that has been investigated in a half-dozen countries.

Yet the avuncular leader with an aristocratic pedigree was still expecting to cruise to another election victory in polls due by mid-2018, maintaining his coalition’s record of unbroken rule since independence in 1957.

Now, all bets are off. That’s because his former mentor and prime minister for 22 years, Mahathir Mohamad, who turned 92 last month, has agreed to join a fractured opposition alliance and head the government again if it wins. He would be the world’s oldest prime minister if that happened.

Mahathir, along with Najib’s former deputy, Muhyiddin Yassin - fired last year for questioning his boss about the scandal - have formed a new party called Bersatu (Unite). It has opened branches in 165 of parliament’s 222 constituencies, Muhyiddin told Reuters, a feat few opposition parties have managed.

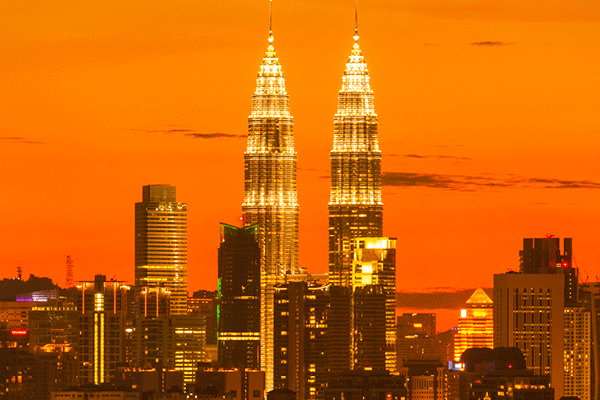

During his 1981-2003 rule, Mahathir championed modernisation by switching Malaysia’s focus from plantations and mining to a diversified high-tech manufacturing base on the back of foreign investment. He built the world’s tallest buildings at the time, the Petronas Twin Towers.

A considerable fan base is excited about his comeback.

“I was still young when Mahathir was prime minister. And I thought anything was possible... maybe cars could fly,” says Nazariah Harun, a former government party supporter in the southern state of Johor, bordering Singapore.

Mahathir also dealt ruthlessly with opponents, jailing his former deputy – and now alliance partner – Anwar Ibrahim on corruption and sodomy charges in the late 1990s.

The opposition alliance hopes to capitalise on a couple of scandals that are resonating in rural Malaysia.

One is around the state’s 1Malaysia Development Berhad (1MDB) strategic development fund that Najib, 63, founded after taking power in 2009. Its murky transactions through overseas front companies and Middle Eastern partners, many of them exposed by foreign media reports, have bewildered the public over the past two years.

Najib insisted he did nothing wrong when it leaked to the media that $700 million wound up in his bank account before the 2013 election.

The other scandal, involving state plantation company FELDA, is more problematic because it directly affects tens of thousands of small landholders in the heartlands. They are a key vote bank for Najib’s party, the United Malay National Organisation (UMNO).

UMNO PATRONAGE

The 1,600 residents of Kuala Sin, a village of farmers and rubber tappers in Mahathir’s home state of Kedah, are switching from UMNO to Bersatu, says UMNO’s former chief there.

“I’ve held the ballot box here (for UMNO) from 1962 until 2014... but this year, God willing, UMNOwill lose,” says 77-year-old Ramli Mat Akib at his weathered two-storey wooden home in Kuala Sin. The UMNO branch office opposite his home has closed.

Mahthir’s son Mukhriz, who leads Bersatu’s campaign in Kedah, believes it is “making huge headway” in rural Malaysia. “It goes all the way down to the branches, and in Kedah very many UMNO branches have dissolved,” Mukhriz says. – Joseph Sipalan and Praveen Menon of Reuters