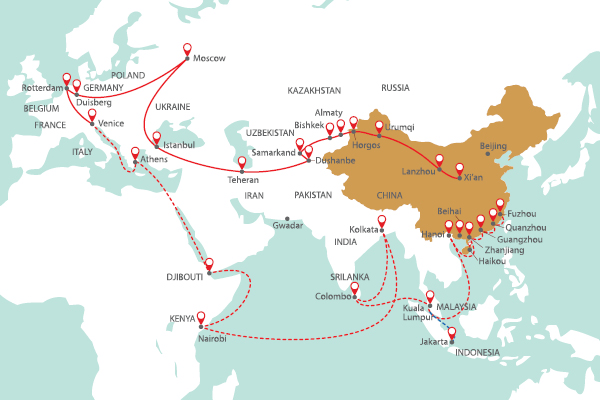

China’s trillion-dollar Belt and Road Initiative is expected to impact a significant chunk of the world’s economy, especially large swathes of Asia, Africa and Europe. And offshore financial centres are an important part of this strategy, translating to increased work for lawyers.

China’s Belt and Road Initiative has been receiving increasing attention internationally, and for good reason, as the initiative aims to boost trade ties and investment across countries in Asia, Africa and Europe.

“The Belt and Road Initiative is an interesting and ambitious undertaking. At a time when populism and anti-globalism seems to be spreading across the globe, the initiative is in stark contrast,” says Stephen Adams, managing partner at Collas Crill’s Singapore office. “The ability to encourage the investment of private funds alongside the funds on offer by China will be critical to the success of the overall Belt and Road initiative.”

The trillion-dollar initiative that includes large-scale infrastructure construction projects is an ambitious feat. It aims to connect 68 countries in Asia, Europe and Africa through an infrastructure-building plan funded, in large part, by China.

”As you know, China has been engaged in widespread infrastructure investment globally as part of the Belt and Road Initiative,” says Kristian Wilson, partner at Bedell Cristin in Singapore.

To achieve this, the initiative requires bringing together international joint ventures and find ways to deploy massive amounts of capital in different countries. “It is a period where Chinese capital is moving out of China, compared to, historically, capital moving inbound,” notes Wilson.

This shift is likely to create significant amounts of work for legal professionals that specialise in offshore structures but to reap the most benefits they will have to be aware of the many implications including in China’s ambitious plan.

OUTBOUND OBSTACLES

As Wilson notes, the increased attention given to the Belt and Road initiative comes at a time when China’s currency restrictions continue with some outbound deals being stalled since last year.

In 2016, China’s outbound investment hit a record high. According to M&A intelligence provider Mergermarket, Chinese companies invested over $51 billion into the U.S. via 65 deals in 2016. That is a 360 percent surge from 2015 when Chinese companies invested $11.7 billion.

Alarmed by the surge of overseas acquisitions included in these deals that seemed unrelated to the core businesses of some companies, Chinese authorities quickly moved to tighten capital control to stabilise the currency. Although a formal, unified approach is yet to be seen, regulators are closely examining overseas investments more than ever, for authentic investment transactions and for strict compliance with all related rules and regulations.

As a result, Chinese outbound investment dropped nearly 46 percent to $48.19 billion in the first half of the year, according to the Chinese Ministry of Commerce. And there has also been a slowdown of activities in the free trade zones (FTZs). Currency restrictions are bleeding into delayed approvals for Chinese companies that are looking to invest out of China.

Although there is significant funding commitment coming from China, it is generally thought that there is a substantial gap between the committed and the required amount of funding to build the infrastructure Asia will need over the next two decades.

OFFSHORE IN PLAY

Despite these concerns, offshore financial centres (OFC) such as Cayman Islands and British Virgin Islands (BVI) continue to be the nexus for China’s outward strategy, particularly for the Belt and Road Initiative.

Kristy Calvert, a partner and chief representative at Harneys, said there has been an increased amount of activity under the initiative.

“[There are] more infrastructure deals than in the years preceding its launch by Chinese President Xi Jinping in 2013,” she said.

Despite some deals having been stalled from the leading state-owned enterprises (SOEs) and private players in the second half of last year due to currency and approval restrictions, Calvert said her firm achieved significant growth in the region, particularly for fund formations and other deals from China.

Calvert has been seeing top-end fund managers who specialise in infrastructure projects overseas touring Chinese cities to make deals on the back of the Belt and Road initiative.

“Many of the leading international forums on the Belt and Road initiative were held in the second quarter of this year throughout China’s major cities. Dedicated Silk Road associations have also been formed in recent months, with some enjoying fantastic support and assistance from the provincial government,” she says.

Given that Belt and Road is a Central Government initiative, it comes as no wonder that the provincial governments are particularly active, as there are so-called “achievements” on the Belt and Road initiative that each provincial government official can talk about when reporting upwards.

Calvert also notes that the Belt and Road momentum offers exciting prospects for the use of offshore holding companies for the structuring of these large outbound deals, in particular Cayman and BVI companies, depending on the location of the ultimate investment.

Cayman Islands’ success is predicated on the jurisdiction and its experienced service providers providing a neutral efficient hub connector for capital and financing around the world.

Along with Cayman Island, BVI stands as one of the world’s largest OFCs for the incorporation of companies, especially those facilitating cross-border trading and investments.

BVI has continued to prove to be successful for Chinese corporation for the last 30-35 years.

And both offshore vehicles stand to benefit from these initiatives. “In general, China continues to present significant deal flows, ranging from Chinese fund managers going out to set up their U.S. dollar funds to help manage the increasing pool of high net worth individuals with money overseas, to IPOs and top-end M&A transactions,” she says.

“Cayman and BVI structures continue to have a central role in these deal flows, given many of these structures have already become embedded over the past decades in the structures of China’s lead international players,” she adds.

Christopher Bickley, a partner and head of the Hong Kong office at Conyers Dill & Pearman agrees and notes that the OFCs are playing a “material role in the Belt and Road initiative”.

“In particular, we see and expect to see an increase in funds formation with investment objectives linked to China Belt and Road Development. We are also seeing many of our infrastructure clients looking to independently raise funds for infrastructure development, particularly in Western China,” says Bickley.

David Lamb, partner and co-chairman of Conyers Dill & Pearman provides some recent trends he has been observing regarding OFCs.

“The M&A market continues to be active with Cayman being the top target jurisdiction for offshore transactions,” he notes.

Lamb says the Cayman team of Conyers Dill & Pearman has been involved in a number of high profile multi-billion dollar acquisitions in the past years, particularly in the insurance sector, and has worked closely with the M&A team in the Hong Kong office on a significant number of mergers originating in Far East.

“Our M&A practice also benefits from our strong presence in the private equity sector as many acquisitions and disposals are downstream transactions for private equity and venture capital funds,” notes Lamb.

Bickley further adds that in terms of IPOs and capital markets, the first six months of 2017 have been particularly active. For IPOs, the first half of 2017 has seen 53 Cayman companies launching on the SEHK, with their offerings totalling $2.269 billion in value.

In addition, Anthony Webster, head of the Asia private equity practice and a partner of the funds team at Maples and Calder, points out that Cayman Islands is a trusted, reliable and well-regulated financial centre, which plays a valuable role in global financial capital flows.

“It is a premier global financial hub efficiently connecting law-abiding users and providers of investment capital and financing around the world – benefiting developed and developing countries,” he says.

CHANGING WORK

China’s Belt and Road initiative includes many substantial infrastructure construction projects, such as power stations, roads, rail, ports and maritime shipping facilities.

Wilson of Bedell Cristin sees both existing and new offshore structures being used. Existing offshore structures such as holding companies, investment vehicles, financing vehicles are still in use, and they are either targets for Chinese investment, acquisition or joint ventures. At the same time, newly set up offshore structures for acquiring funds and investing in projects is also widely used.

As a result, the type of work Wilson sees going forward may be focused on Chinese investment in Asia through BVI vehicles or into BVI vehicles. “The type of work could be advising on the financing arrangements to a BVI company or fund where it is raising funds to invest in infrastructure projects, or advising on M&A or joint venture aspects of a deal where the acquirer or investor is seeking to invest in a BVI target,” he notes.

Wilson has also worked on a number of deals in Southeast Asia that involved Chinese investment into real estate or infrastructure projects.

“The main type of work we have seen has been project f nancing related, mainly infrastructure investment, or joint venture and M&A related, in the form of co-investment in the acquisition of hard assets,” he adds.

“We have also worked on funds transactions, where the clients have raised funds with the intention of investing in hard assets, although this is more in the private commercial space,” notes Wilson.

COMING TOGETHER

Webster of Maples and Calder points out that China’s major infrastructure projects built along the Belt and Road corridors bring together investors, lenders, construction companies and other business enterprises in very complex transactions.

“This requires detailed analysis of legal, regulatory and tax parameters of multiple countries. These require the creation of international joint ventures between Chinese companies and foreign business; huge amounts of capital to be deployed from and to many countries in order to finance them, including capital from Chinese and international investors, lenders, development banks, agencies and private investors,” he notes.

Webster says he has observed the increased use of Cayman vehicles since Belt and Road’s inception.

“In fact, we have been told by one Chinese organisation that is fundamental to Belt and Road, that Cayman vehicles are their preferred choice when structuring transactions,” says Webster.

And so far, he’s seen a number of Cayman Islands private equity funds, project financing and joint venture firms being formed specifically to invest in Belt and Road projects.

“Very often a company or other legal entity based in a neutral jurisdiction, such as the Cayman Islands, is the most efficient way to bring those international stakeholders involved with a project together in a business-friendly and cost-effective structure,” he adds.

For these reasons, the use of Cayman Islands vehicles predates the Belt and Road initiative. Cayman Islands vehicles have long been playing this type of role in international project financing and investment fund structures for many decades.

“Cayman Islands companies have been used extensively in the development and financing of infrastructure projects in many countries, whether through debt and equity financing vehicles, such as private equity and venture capital funds, bond-issuing vehicles and capital markets solutions, such as international public offerings, public-private sector partnerships (PPP) and securitisations,” says Webster.

He further adds, “The experience and expertise which exists amongst Cayman’s legal, accounting and other professional advisors based both in the Cayman Islands as well as in other key financial centres such as Hong Kong, London and Dubai, working together with institutional financial institutions, lenders, development banks, agencies and legal and professional advisors based in many other countries, play a very meaningful and valuable role in structuring the transactions that support the Belt and Road initiative.”

Going forward, Webster believes that he will continue to see strong growth in the use of Cayman and BVI vehicles by the Asian business community.

BELT AND ROAD OPPORTUNITIES

In terms of a wider perspective from the offshore area, Wilson sees many OFCs are following the Belt and Road initiative closely. And recent developments signals how OFCs are evolving according to global demands.

Take legislative changes. Both the Cayman Islands and BVI recently introduced legislation requiring certain companies and limited liability companies to create and maintain a (non-public) register of beneficial owners.

What this means for Belt and Road market users is continued confidence in the BVI to facilitate their cross-border transactions and investments.

“The BVI has been at the forefront of this space more than ever, with BVI Asia House on the ground for several years now, and the BVI Government having taken a roadshow to China recently,” notes Wilson.

“In addition, a private bank, the Bank of Asia, has recently opened in the BVI backed by Hong Kong-based shareholders, which not only points to the continued relevance of the BVI in Chinese investment, but is in and of itself representative of the belt and road, as it is itself a new institutional investment in the Caribbean.”

Adams believes the opportunities for OFCs lies in the fact that countries along the Belt and Road initiative have different languages, cultures and legal systems in various levels of development.

“The ability to structure a foreign investment through an OFC offers investors the certainty they require which may not otherwise be available through a direct investment.

From an investee country perspective the use of an OFC enables it to have access to a pool of highly qualified and experienced professionals that may not be available locally,” he notes.

Most OFCs offer tax neutrality, flexibility, stability and legal certainty that many times are not available in the country where the investment is made.

Going further, Adams sees OFC playing similar roles as it has with foreign direct investment (FDIs) when it comes to the Belt and Road initiative.

Drawing from his experience with offshore centres playing the conduit role in foreign direct investment, Adams expects that investments made along the Belt and Road route to be structured, similarly through an OFC.

“OFCs have always acted in a complementary fashion with jurisdictions, such as Hong Kong, London, Singapore, and we would expect that investments made along the Belt and Road route to be structured similarly through an OFC,” notes Adams.

THE RISE OF CYPRUS

While BVI and Cayman island has long been favourites for Chinese investors, the use of mid-shore jurisdictions such as Cyprus is also becoming increasingly popular, according to Calvert.

“Harneys’ Cyprus office, being one of the largest international law firms in the region, is seeing a rise in instructions,” she notes.

“This is evident from various important developments in recent months between the Cyprus and Chinese governments.”

Some of the benefits Cyprus offers includes a passport that is given for a $2.3 million property investment. Secondly, the location of Cyprus is ideal to set up shop for investments in several parts of the world.

These are namely Eastern Europe, Southeast Europe, the Middle East and North Africa.

The geographical importance was remarked by Huang Xingyuan, Chinese Ambassador to Cyprus, while reporting updates on the Belt and Road Forum for International Cooperation, this year in Beijing. Huang emphasized that Cyprus could play an important role in promoting the Belt and Road initiative.

The support between the two is mutual, with Cyprus Education Minister Costas Kadis present at the Belt and Road Forum in Beijing in May.

NEXT STEPS

Going forward, it is clear that the use of OFCs – both traditional and new – within Belt and Road market users will only continue to increase as there is a clear demand, despite overall use of OFCs tends to be down when compared to historical numbers.

“While the number is nowhere near traditional numbers, it is still substantial. It is likely that automatic exchange of information (AEOI) initiatives, and various other things, have caused the mass incorporation end of the market to become tighter,” says Adams.

That said, the trend in OFC is moving toward higher regulation and transparency in response to international initiatives.

“Complying with these international standards requires substantial investment by OFCs and it would not be surprising if there were a rationalisation in the number of centres describing themselves as OFCs in the coming years as the cost of international compliance becomes prohibitive for certain centres,” he notes.

This can be traced from uptick in business in places like Hong Kong and Singapore, which are done at the expense of OFCs.

“The current environment is becoming increasingly complex and there appears to be a move toward more quality and reliable service providers and jurisdiction. This is coupled with the provision of more value added and sophisticated services,” says Adams.

“The fact remains, whether critics want to acknowledge it or not, that OFCs support the global economy and facilitate capital flows and investment across borders,” he adds.

Anthony Oakes, partner at Ogier, a firm that provides legal advice on BVI, Cayman, Guernsey, Jersey and Luxembourg law, agrees.

Oakes believe that various OFCs will still be relevant, “Jersey will continue to be popular for transactions involving UK based property. Mauritius and Singapore are typically the channels for foreign investment into India. Luxembourg vehicles, particularly Undertakings for the Collective Investment of Transferable Securities (UCITS), remain a popular choice as a gateway for investing into Europe.”

Oakes further adds that the OFC used in particular investments would depend on the location of the project and the tax treatment being sought.

“Without doubt, OFC will benefit from the Belt and Road initiative. The traditional favourites of the Chinese market, Cayman and BVI, will continue to be used – BVI entities as holding companies and Cayman entities as investment funds, both private equity and hedge funds,” he says.