The shipping industry may be expecting to see some recovery in 2018, but it faces a number of other challenges, ranging from increasing regulations to the rapid emergence of technology – and resulting cybersecurity concerns. As a result, lawyers have more of a role to play to guide them through this changing world.

The year 2018 should be a better one for the shipping industry. With the dark days of 2015-16 hopefully behind it, industry experts expect waters this year. “[We believe] that, in 2018, demand in the three main segments of the global shipping industry (dry bulk, tankers, and containers) will outstrip supply for the first time in several years,” says a note from ratings agency S&P. “The lighter new vessel delivery schedule for 2018, compared with 2017, combined with our expectation of sustained imports of commodities, and longer distances travelled, point to rising charter rates across the shipping industry this year… What’s more, given the fundamental improvement in supply conditions, as signified by ship orderbooks being at close to all-time lows, we think the recovery in shipping rates could continue beyond 2018.”

This is a trend that lawyers are noticing as well. “Surprisingly, despite oil prices being depressed for most of 2017, the shipping industry in Singapore had seen an uplift in terms of both the volume and prices of freights,” says Peter Doraisamy, managing director of Singapore law firm Peter Doraisamy. “Accordingly, we were instructed on more matters pertaining to the review of the various types of freight contracts and disputes pertaining to the non-delivery and/or breach of freight contracts.”

Another trend that lawyers are noticing is the reduction in maritime incidents. “The increased professionalism in the manner in which vessels are operated today, as well as improved safety practices, have reduced the frequency of maritime incidents, including shipboard issues,” says John Sze, deputy managing partner of Joseph Tan Jude Benny (JTJB). “Further, we see an increasing trend by the vessels’ insurers to take a more hands-on approach in dealing with disputes and maritime incidents. A combination of these factors, I believe, has led to a general reduction in litigation cases particularly in Singapore. This can be seen from a decrease in ship arrests and maritime cases before the Singapore courts in 2017, with Singapore Chamber of Maritime Arbitration (SCMA) caseload remaining at a similar level in the past couple of years.”

Sze adds that there has however been a corresponding increase in advisory work relating to managing counterparty risks, as well as insolvency and restructuring work. “This is particularly seen in the oil and gas sectors, where the consistently depressed oil prices has seen many players in that market finding significant difficulty in finding commercial employment of their vessels and other assets, and correspondingly running into cash flow issues. At the same time, construction of vessels for the oil and gas market has significantly slowed down, which has impacted the shipyards and equipment suppliers.”

For Bazul Ashhab, managing partner, and Prakaash Silvam, senior associate, of Oon & Bazul, 2017 was a challenging year for the shipping sector. Two key trends they noticed were an increase in insolvency and restructuring work, and an increase in cybercrime in shipping operations. “As both shipowners and charterers continue navigating a choppy economy, there were more cases of insolvency, and in a bid to stave off insolvency, concerted focus was on restructuring to streamline operational costs,” they say. “A key change in 2017 was Singapore’s formal adoption of the UNCITRAL Model Law on Cross Border Insolvency, which came into effect on May 23 last year.”

They note that the Model Law provides a platform for the Singapore court’s recognition of and assistance to foreign insolvency process, the nature and extent of such recognition and assistance turning on whether the foreign liquidator was appointed in the insolvent company’s Centre of Main Interests (COMI). “Under the Model Law framework, recognition is largely a formalistic process and upon an application being made by a foreign representative in the proper form, foreign insolvency proceedings will be mandatorily recognised, subject to the public policy exception,” Ashhab and Silvam say. “With this, foreign insolvency office holders appointed in proceedings commenced from May 23, 2017, onwards, now no longer rely on the common law to recognise foreign proceedings; the Model Law gives them direct access to the Singapore courts to seek recognition of foreign insolvency proceedings, and obtain interim relief in respect of the debtor’s assets while the courts decide on the main application.”

While the Model Law does not provide for restructuring of a foreign company’s debts and liabilities in Singapore, the amendments to the Companies Act in 2017 extended Singapore’s Scheme of Arrangement and Judicial Management mechanisms of restructuring to foreign companies which are liable to be wound up under the Companies Act, they add. “Singapore’s adoption of the Model Law and extension of the Scheme of Arrangement and Judicial Management regimes are positive developments for cross-border insolvency practice, judicial management and restructuring in Singapore,” say Ashhab and Silvam. “With a growing number of global maritime and offshore firms with complex cross-border corporate and asset holding structures going into liquidation or looking to quickly and efficiently restructure to avoid liquidation, these changes to Singapore’s insolvency and restructuring laws may see more global maritime and offshore firms looking to Singapore as an attractive jurisdiction to restructure. We can already see this happening with two major troubled players, EMAS Offshore Limited and Nam Cheong choosing to restructure their debts in Singapore, and recently having their proposed scheme of arrangements successfully obtaining creditor approval.”

REGULATORY BURDEN

One challenge that shipping companies are expected to face more of this year is the prevalence of regulations aimed at making ships more environmentally friendly. The most important of these facing ship owners today is one related to reduction of marine fuel sulphur by 2020, which was announced by the International Maritime Organisation (IMO) in 2016. Under the new global cap, ships will have to use marine fuels with a sulphur content of no more than 0.5 percent by Jan. 1, 2020, against the current limit of 3.5 percent. The move is expected to cut sulphur emissions in the shipping industry by 85 percent compared to today’s levels, with the aim of improving air quality and protecting the environment. At a meeting held in February 2018, the IMO agreed to move forward with a ban on the carriage of fuel oil on board ships that do not comply with the new low sulphur limit.

“The 2020 global 0.5 percent sulphur cap is a positive development to making the shipping sector ecologically friendly as it remains the primary mode of transporting goods,” say Ashhab and Silvam. “The 0.5 percent global limit is a significant reduction from the present 3.5 percent global limit. However, shipowners, refiners and bunker suppliers have had ample time since 2008 to prepare for the reduction given the early notice, and the long-standing general trend towards reducing sulphur emissions.”

Moving forward, they note that a concern on the supply side would be whether there is sufficient compliant fuel oil in bunkering ports to meet the demand for the same. “On the other hand, shipowners will have to be ready by preparing for increased cost of compliant low sulphur fuel oil, or higher priced marine gas oil, unless they are prepared to retrofit their vessels to run on alternative clean fuel such as LNG fuel or methanol, or install exhaust gas cleaning systems,” say Ashhab and Silvam.

While the upcoming global sulphur cap is believed to be the single most significant regulatory milestone on the shipping industry's horizon, vessel owners are becoming increasingly aware of what further regulatory changes lie ahead. For example, another one is the International Convention for the Control and Management of Ships’ Ballast Water and Sediments, which came into force in September 2017 and is aimed at controlling the transfer of potentially invasive species.

An area of concern for the industry is that as there is no convention, or even a non-preemptive existing legal framework, different jurisdictions are free to enact additional and potentially inconsistent regulations. Lawyers thus need to guide their clients through these regulations. “There are a significant number of regulations that require shipowner compliance, but in the main, these relate to matters requiring technical compliance,” says Sze. “We continue to monitor these regulations closely and advise clients on legal compliance issues.”

THE TECH FACTOR

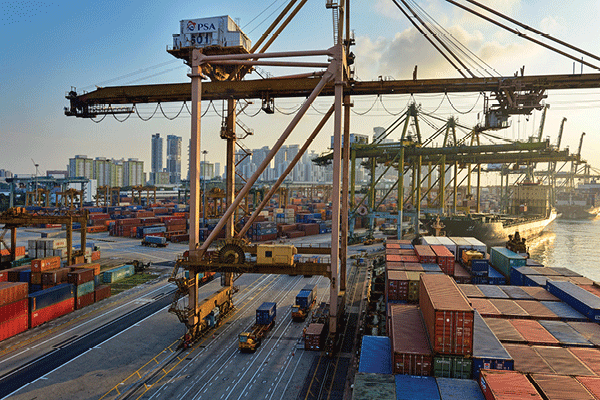

A number of traditional industries around the world are today being impacted by technology, and shipping is no different. This is not a new trend though; unmanned engine rooms have been around for many years, e-navigation has been a focus of industry bodies for more than a decade now, and more and more container terminals, including Los Angeles and Qingdao, are fully automated. Several companies are working on fully autonomous vessels as well.

While fully autonomous “robot” might still be some years away, companies are stepping up their game when it comes to technology. A survey carried out by the Business Performance Innovation (BPI) Network, in coordination with technology provider Navis, found that although the sector is suffering from costly inefficiencies due to ineffective data sharing and poor cross-industry collaboration, nearly half (46 percent) of respondents said their companies were either investing significantly in new technologies or significantly increasing those investments. Now they also need to ensure that personnel have the skills necessary to work effectively with these new systems, and also that the systems can work well with the existing setup.

Additionally, they need to take into account the role played by exciting new technologies like blockchain, and how these can be harnessed to improve the industry. For example, the world’s largest container shipping firm, A.P. Moller-Maersk recently announced it is teaming up with IBM to create an industry-wide trading platform it says can speed up trade and save billions of dollars. [SEE BOX] “The emerging trend in the shipping industry is the use of technology, in particular, blockchain technology, in areas as varied as port operations, cargo management and trade financing,” says Sze of JTJB.

Ashhab and Silvam of Oon & Bazul note that while the maritime and shipping sector has been a traditionally document-heavy one, the use of digital technology provides potential for greater efficiency and lower costs as the sector moves towards paperless trading. “This trend has been industry-driven, with shipowners and P&I Clubs working together since 2010 to facilitate and refine a working legal and practical ecosystem for the use of digital trade documentation, including electronic bills of lading, which have the legal and functional traits of a paper bill of lading,” they note. “We can see this in the development of three electronic bill of lading systems which have gained industry approval – Bolero, essDOC and e-Title – all of which have their own sophisticated legal framework.”

Adds Sze: “I believe that in the very near future, we could well finally see the end of paper bills of lading, after decades of attempting to introduce electronic bills of lading without success. The firm is at the forefront of advising maritime players such as trading houses and vessel operators on the legal implications and responsibilities as the bills of lading traverse in these new platforms that are being trialled.”

In Singapore, the push to take the shipping sector digital has been actively driven by the country’s government. “In 2018, the Singapore Shipping Association (SSA), Singapore Customs, and Maritime Port Authority of Singapore (MPA) signed a Memorandum of Understanding to push for a move towards the digitalisation of trade and maritime documentation in the industry,” they say. “On a more practical side, the MPA also signed a Memorandum of Understanding with SSA and Glee Trees on developing a proof-of-concept using robotic process automation for the development of an automated ship agency tool, which would automate and streamline essential services such as port and crew clearance for vessels.”

Ashhab and Silvam add that the use of automated processes and digital trade documents will invariably give rise to new types of disputes. “On our part, we will not only need to keep up to date with how technology will affect claims in the shipping sector, but be creative in analysing how traditional legal principles may be evolved and applied to resolve these new variants of disputes,” they say.

For Doraisamy at Peter Doraisamy, the firm’s focus in the area of technology has always been to manage clients’ exposure to losses following technology failure. “In order to achieve the aforesaid, we have recommended to our clients the possibility of widening the ambit of the force majeure clause in their standard terms and conditions so as to cover unexpected technology failure,” he says. “Separately, we foresee that as the shipping industry increasingly embraces technology, its reliance on labour will dwindle.”

CYBER RISKS

However, the increase in automation and digitization brings with it risks to cyber security. Few companies know it better than the aforementioned Maersk, which suffered a reported $300 million in damages following a hit by the NotPetya ransomware outbreak in June last year. The shipping giant was infected with a virus that spread into its global network, forcing it to halt operations at dozens of port terminals around the world. Over a period of 10 days, Maersk was forced to reinstall 4,000 servers, 45,000 personal computers and 2,500 applications, according to the company’s chairman, Jim Hagemann Snabe, who described the episode as a “very significant wake-up call.”

Attacks even on a smaller scale can have grave repercussions for all parties. “In 2017, our firm also saw a troubling increase in cybercrime in shipping operations. There has been a spat of charterparty disputes where technologically savvy fraudsters have hacked into the email accounts of shipbrokers,” say Ashhab and Silvam. “The fraudsters gain access to and doctored the freight invoices by changing the payee bank account details. The shipbrokers proceeded to send out the doctored invoices to charterers for payment; the charterers made payment into the bank account stated on the doctored invoices; and the shipowners subsequently try to claim against the charterers for non-payment. This is a troubling development as neither the ship-owners nor the charterers are blameworthy for the misdeeds of an invisible hacker, against whom no proceedings may be brought. In turn, the courts have to struggle deciding where the loss should fall between the two innocent parties.”

Sze says that while prevention and reduction of cyberattacks is primarily a cybersecurity issue, such attacks will have significant legal implications from data protection issues, risk of theft, false information being circulated to customers, and delay and/or damage to goods being shipped, and even to communications between vessels and operations teams. “It is also important to note that the parties conducting cyberattacks are often very difficult to detect and identify, making it very difficult for companies to have recourse against the perpetrators for the financial losses that the company might suffer,” he says. “It is therefore important to manage these legal risks and liabilities to third parties even as companies seek to do their best in improving cybersecurity in their company.”

Ashhab and Bazul say the risk of cyberattacks may be mitigated by regular and root reviews of shipping companies’ own IT systems. “While the usual protective measures of installing up-to-date anti-virus software and updating system software patches are recommended, we are aware that a bulk of the risk to IT systems is from users who open up vulnerabilities to external attacks from within,” they say. “It will be important for shipping companies to regularly train their operations personnel on safe IT best practices, and to implement internal governance and procedural rules for staff who have access to and deal with digital trade documents.”

On the legal front, firms also have to be creative in pre-emptively spotting risks which may arise from cyberattacks or the use of digital documentation and processes, they add. “We are also able to review trade and shipping contracts and recommend provisions which fairly distribute the liability for cyberattacks between contracting parties,” say Ashhab and Silvam.

Doraisamy says the protection of confidential information, intellectual property rights and the need for clients to seek immediate redress are vital in an event of a cyberattack. “Hence, in helping our clients’ mitigate the adverse effects of a cyberattack, we have recommended implementing solutions from as simple as the labelling confidential documents as such to ensuring that third parties agree to carefully prepared non-disclosure agreements,” he notes.

WHAT TO EXPECT IN 2018

Doraisamy says that in 2018, he foresees a more widespread use of technology in the shipping industry, in particular, the adoption of dynamic pricing for freight shipping providers. “Additionally, the rise of online retail may drive the narrowing of the spread between the demand for freight and capacity,” he notes.

Technology is also a key trend this year for Sze. “In 2018, I finally see a widespread adoption of electronic forms of bills of lading through platforms being trialled,” he says. “Also, increased automation of vessel operations could lead to issues relating to questions on liability when a maritime incident and/or equipment failure occurs – Does the increased automation of vessel operations reduce the liabilities of the vessel’s crew and engineers, but there is a corresponding increase in liability placed on equipment and software suppliers, as well as shore-based personnel who could increasingly manage vessel systems remotely?”

Meanwhile, Ashhab and Silvam expect to see the trend of market consolidation continue in 2018. “As the oversupply of tonnage persists, it is likely that ship owning companies will informally and formally form alliances to pool their resources and consolidate their assets to maintain efficiency and increase competitiveness in the market,” they say. “In view of a global trend towards making the shipping sector more ecologically friendly, we also expect shipowners to invest in future-proofing their fleet by retrofitting their vessels or by investing in new buildings which are capable of running on cheaper, greener fuel such as LNG. While the IMO regulation is focused on a global 2020 global sulphur cap, it is only a matter of time before the regulators turn their attention to putting a cap on carbon dioxide emissions by vessels as well.”

Maersk, IBM to launch blockchain-based platform for global trade

By Jacob Gronholt-Pedersen of Reuters

The world’s largest container shipping firm A.P. Moller-Maersk is teaming up with IBM to create an industry-wide trading platform it says can speed up trade and save billions of dollars.

The global shipping industry has seen little innovation since the container was invented in the 1950s, and cross-border trade still leaves an enormous trail of paperwork and bureaucracy.

Success of the platform, which will be made available to the ocean shipping industry around mid-2018, depends on whether Maersk and IBM can convince shippers, freight forwarders, ocean carriers, ports and customs authorities to sign up.

Blockchain technology powers the digital currency bitcoin and enables data sharing across a network of individual computers.

It will help manage and track tens of millions of shipping containers globally by digitizing the supply chain process from end to end, the companies said.

“The big thing that is missing from this industry to digitize and unleash the potential of the technology is really to create a form of utility that brings standards across the entire ecosystem,” Maersk’s Chief Commercial Officer Vincent Clerc said in an interview.

A shipment of refrigerated goods from East Africa to Europe can go through nearly 30 people and organizations and involve more than 200 different communications, according to Maersk. Documentation and bureaucracy can be as much as a fifth of the total cost of moving a container.

“There is a strong push from the end-customer to see this change. We may meet initial resistance from one part of the ecosystem,” Clerc said.

“The success of the platform depends on acceptance of all participants.”

Customs and port authorities in the United States, Singapore, the Netherlands and China’s Guangdong province have shown interest in using the platform and some other shipping companies are also interested, he said.

Maersk, which handles one in seven containers shipped globally, sold off its energy business in 2017 to focus entirely on transportation and logistics.

A cyber attack last year caused some of the biggest-ever disruptions to global shipping, displaying the vulnerability of out-dated communication systems. Maersk’s container and port operations were hit for weeks, as it struggled to bring its IT systems including some 1500 applications back online.

The joint venture will be headed by the previous chief of Maersk Line’s North American operations, Michael J. White. Maersk and IBM first announced their cooperation in March.