The Cayman Islands is an early adopter of the Common Reporting Standard, compliant with FATCA, and a leading jurisdiction on tax transparency. Anti-money laundering and anti-terrorist financing legislative regimes aspire to the highest international standards, and the Cayman Islands’ commitment to compliance is unwavering. The Cayman Islands government and financial services industry together have a long history of working closely and cooperatively with key intergovernmental organisations.

One of these intergovernmental groups, the EU Code of Conduct Group, assessed the tax policies of a number of countries, including the Cayman Islands, in 2017. Following assessment by the Code of Conduct Group, the Cayman Islands was included in a list of jurisdictions required to address the Code of Conduct Group’s concerns regarding ‘economic substance’. Like its counterparts in the British Virgin Islands, Bermuda, Guernsey, Jersey and the Isle of Man, the government of the Cayman Islands worked closely with the Code of Conduct Group to ensure that those concerns were adequately addressed. As a result of that engagement, a law to provide for an economic substance test, namely The International Tax Co-Operation (Economic Substance) Law, 2018 of the Cayman Islands (ES Law) and related Regulations came into force on 1 January 2019 with additional Regulations and Guidance issued on 22 February 2019.

RELEVANT ENTITIES

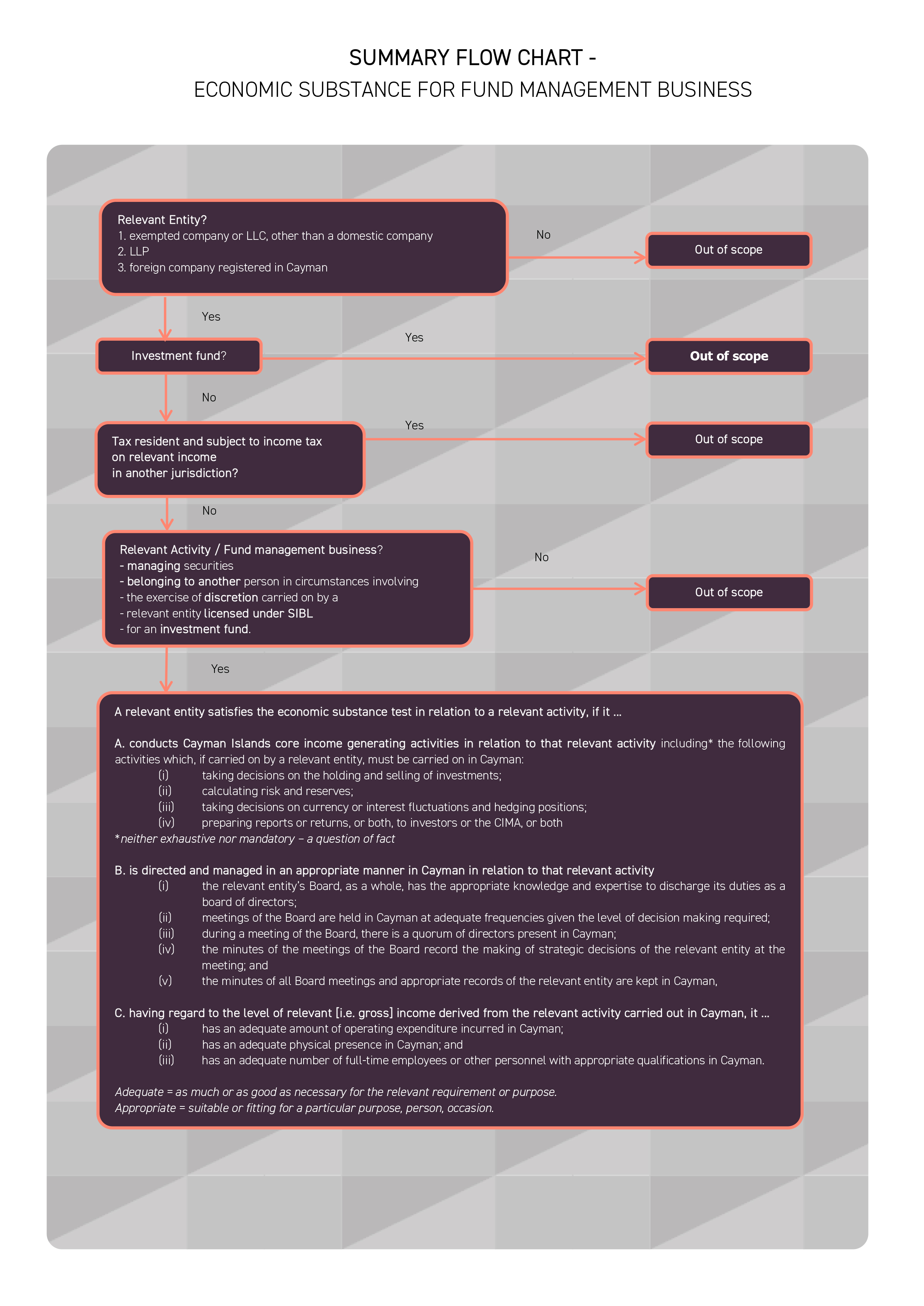

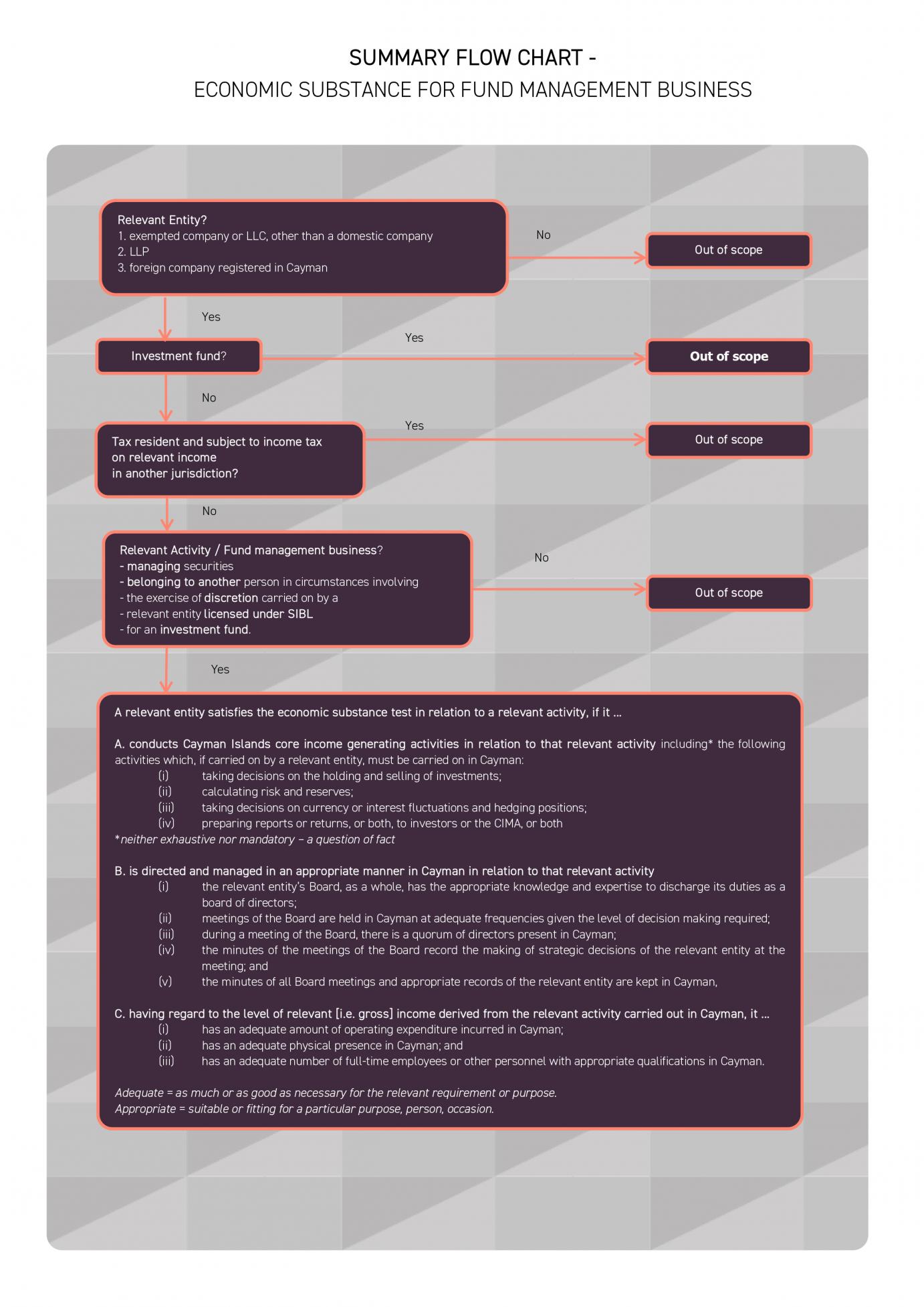

The ES Law applies to “relevant entities” meaning Cayman companies (other than domestic companies i.e. carrying on business locally), Cayman limited liability companies, Cayman limited liability partnerships and foreign companies registered in Cayman, but excludes investment funds and entities that are tax resident outside of the Cayman Islands.

A relevant entity is required to satisfy the economic substance requirements by 1 July 2019, if in existence before 1 January 2019, or on the date on which it commences the relevant activity if it was not in existence prior to 1 January 2019.

FUND MANAGEMENT BUSINESS

The ES Law requires certain entities incorporated or registered in the Cayman Islands and carrying on specified activities to have ‘adequate substance’ in the Cayman Islands. One of the specified activities, and the focus of this article, is “fund management business” which is the business of managing securities belonging to another person in circumstances involving the exercise of discretion, carried on by a relevant entity licensed under the Cayman Islands Securities Investment Business Law (SIBL) for an investment fund.

ECONOMIC SUBSTANCE TEST

A relevant entity conducting fund management business is required to satisfy a 3-limbed economic substance test (as summarised in the flow chart).

POSSIBLE EXPANSION SCOPE

Further, the definition of “fund management business” currently covers only entities that are licensed under SIBL. However, amendments have been proposed to apply economic substance requirements to relevant entities that fall within the definition of, and are registered as, excluded persons under SIBL which are expected to take effect in the not too distant future.

SATISFYING THE REQUIREMENTS

The satisfaction of the economic substance requirements will be a question of fact. There will not be a one-size-fits-all approach and much will depend on the size and nature of the business (both in the Cayman Islands and in other locations) in addition to expected gross income in the Cayman Islands.

Cayman Islands service providers are understood to be developing economic substance solutions to assist with the ES Law. It is generally accepted that the core income generating activities to be carried out in the Cayman Islands will, in most cases, involve the engagement of specialist personnel on the ground. The Cayman Islands’ position as a leading centre for financial services with existing financial services infrastructure and highly qualified professional service providers, however, ensures that it is well placed and able to assist with meeting such additional compliance measures.

FILINGS

Starting in 2020 (exact date to be announced), relevant entities will be required to file a notice with the Cayman Islands Tax Information Authority (TIA) stating whether or not they are carrying out relevant activities. Twelve months after the last day of the end of each financial year commencing on or after 1 January 2019, a relevant entity carrying out any relevant activity will be required to file a basic return setting out particulars as to income, expenses, assets, management, employees, physical presence and other matters. These filings will be examined by the TIA to ensure that the relevant entity has adequate economic substance in the Cayman Islands. If adequate substance is lacking, the TIA will give the entity direction on how to meet the test and may impose a fine of up to USD 10,000. Continued failure to meet the test in the following year may result in a higher fine of USD 100,000 and could lead to the entity being struck off.

NEXT STEPS

All relevant entities conducting fund management business will need to undertake an internal review and analysis to determine what measures, if any, they might need to take in order to achieve compliance. Economic substance issues will be front and centre for the foreseeable future in Cayman as with other international financial centres that have adopted equivalent legislation.

LISTING NOTE

More recently, the European Union published its updated list of non-cooperative tax jurisdictions on 12 March 2019. The Cayman Islands are listed as a cooperative tax jurisdiction as a result of the timely implementation of the economic substance regime.

Author

Christian Victory

Christian Victory

Partner,

Appleby, Cayman Islands